- 07 May, 2015

Dead Frogs and Interest Rates

… and why Stevens needs to be sacked (as the head of Treasury was).

Do you know the story about the frog in warm water?

Little by little the water temperature was increased and the frog didn't notice until – he suddenly died! Yet, this little bit by little bit is the same practice of Glen Stevens.

Ever since he became the RBA Governor, I have been saying that his history is of doing too little too late. Right now markets are disappointed that there was no rate cut in April and the Australian dollar rose immediately, hurting Australian jobs.

What is certain is that the RBA will lower rates and it will be a measly 0.25% and like the frog in the warm water it will have no effect.

Had the heat in the pot suddenly jumped then so would have the frog, right out of the water. So too, the Australian economy has stagnant retail sales as result of rising unemployment. And as a result of all of this the Government tax from GST, PAYG and company profits is stagnant.

That's why Stevens needs to be sacked and someone from outside of the banking sector installed in his place – someone who understands the “frog in the hot water” story and will immediately drop rates to 1.5%. This will cause a wave of enthusiasm and positiveness throughout the economy.

And by not being a banker, he or she will force the banks to pass on previous rate cuts.

Australians pay 125 different taxes. These taxes could be completely eliminated, including the expensive red tape bureaucracy and the massive amount of time associated with it.

The Low Rate Lie!

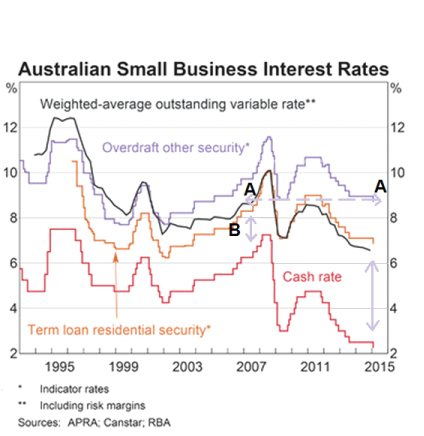

As you can see on the chart, A clearly shows that despite the huge drop in rates since 2007, banks have not passed this on to business.

Where the B is on the chart, you can see that banks in 2007 were lending to business with just a margin of 2 per cent. That means now with the cash rate for 2.25 per cent they should be lending at 4.25 per cent.

Clearly, they are not! They are lending at about 9 per cent.

In 2005 and 2006 we had banking competition and we had rising consumer retail spending and rising jobs. The RBA minutes continually pointed to interest rate margin compression being the reason for this. Back then we had competition.

Then along came Kevin Rudd with his KFC (Kevin’s Financial Crisis) and banking competition has fled the country. Yet another reason to sack Stevens and install a non banker!

So the solution to the budget is easy really – just sack Stevens!